No one likes to have to pay to get paid. Billers pay 1 - 3% of the transaction value to accept debit and credit cards. ACH is cheaper, but takes time to settle so there’s a risk that the goods will be provided before it’s discovered there are insufficient funds.

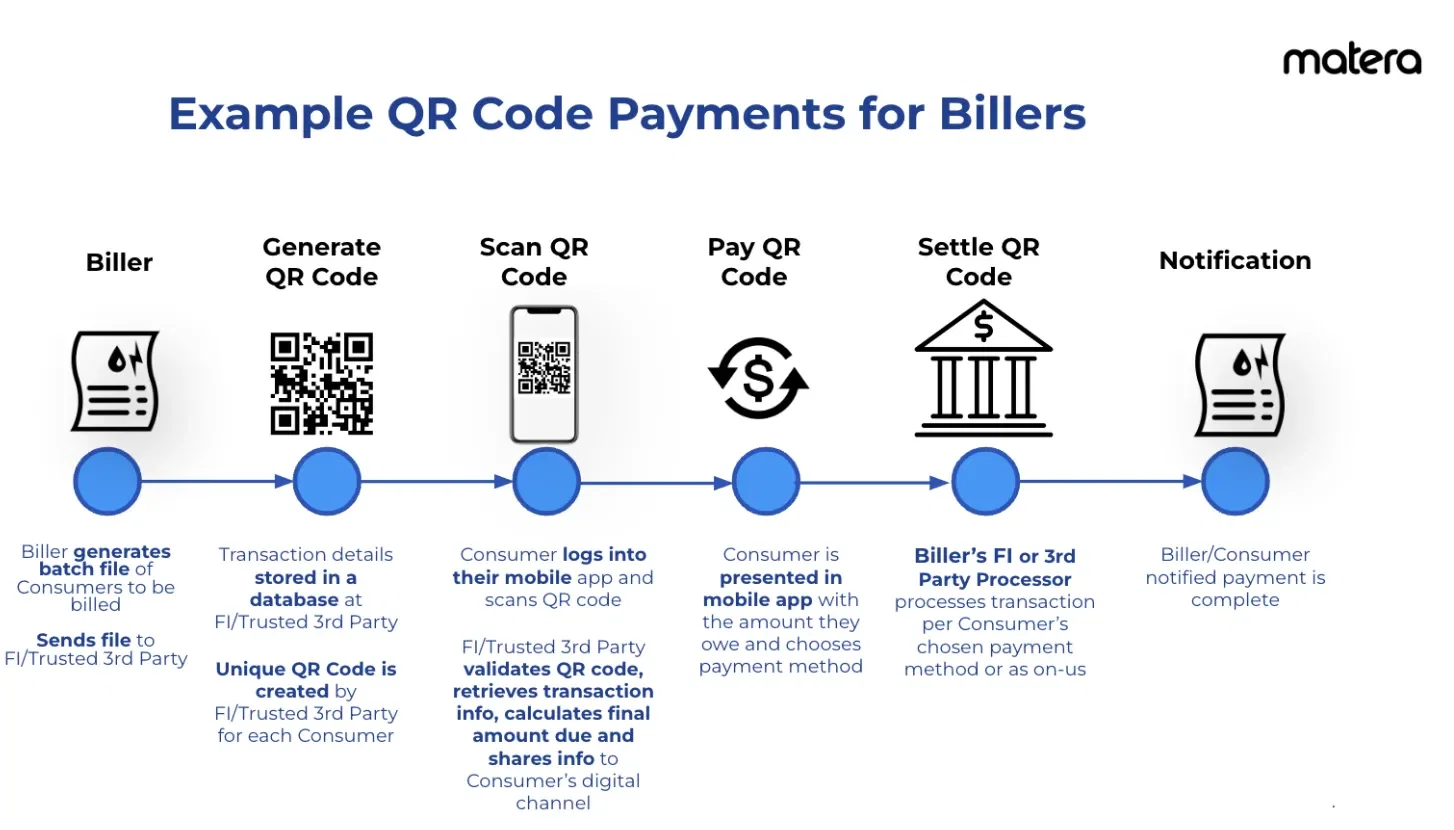

Billers who enable QR Code payments can unlock lower cost instant payment rails and offer a speedier, more convenient, and secure consumer experience.

Merchant-Presented QR Codes

Technically, there are two types of QR Codes that can be used for payments: Merchant-Presented and Consumer-Presented. This post will focus on Merchant-Presented where a Biller presents a QR Code for a consumer to scan and pay. Consumer-Presented will be addressed in a future post.

Requirements

- Billers who want to enable QR Code payments must have a way to present QR codes to consumers.

- They can print QR Codes on physical bills, on an insert included in a mailed envelope, present them at their online bill-pay portal or on an emailed bill.

- Billers must have a payment service provider with QR Code Payment software to facilitate QR Code payments - likely their Financial Institution or a Trusted 3rd Party their Financial Institution relies upon.

- Digital communication needs to be established between the Biller and FI/Trusted 3rd Party so the Biller can send them a batch file with a list of consumers to be billed.

- Once the FI/Trusted 3rd Party puts the data in the batch file in a database and generates a unique one-time use QR Code for each consumer, the QR Code has to be shared with the bill printer so they can add to each consumer’s bill.

QR Code Payment Configuration

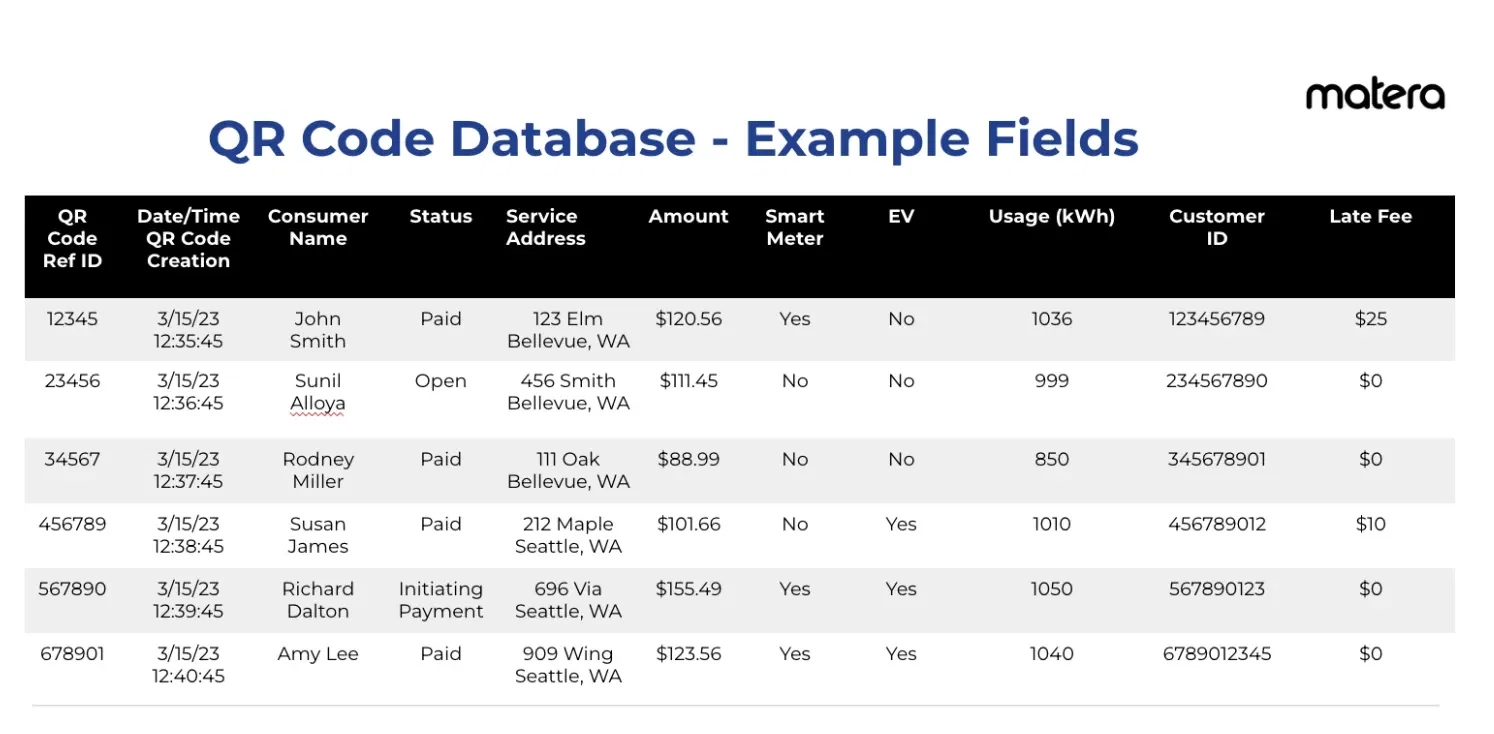

One of the key benefits of QR Code payments is the amount of information that can be included in the payment transaction details. Billers can work with their FI/Trusted 3rd Party to configure the data they’d like to include alongside the transaction details. For example, a utility company may want to know if a consumer making a QR Code payment has a Smart Meter or an Electric Vehicle. These and other fields of information can be captured when a QR Code is scanned and paid.

Billers can also work with their FI/Trusted 3rd Party to decide on the payment method for processing.

- For consumers who have an account at the same FI as the Biller, a low-cost, on-us closed loop transaction between consumer and Biller account is possible.

- Billers with their own mobile app or portal may want to enable multiple payment methods when a QR Code is scanned. If they let consumers add different payment types to their mobile wallet or portal, then, consumers can choose whether to do an instant payment or ACH from their bank account or pay with a credit or debit card.

Late fees and discounts can also be configured.

- Billers can offer a discount for any reason (e.g. for paying by QR Code or for paying early). They can also charge a late fee if a QR Code is scanned and paid after the due date. Discounts and fees are automatically calculated when a QR Code is scanned.

Two other items to be configured include the QR Code expiration and Biller alias.

- QR Codes for payments due at a future date typically expire 30 days after the due date; the Biller can determine this amount of time.

- The Biller alias is the set of alphanumeric characters that represents a bank account and routing number. It can be a phone number, email or a randomly generated string. Billers can choose an alias to represent a financial account where QR Code payments are deposited.

The Biller Experience

Once configured for Biller acceptance, QR Code payments happen in seconds with the processing done behind the scenes by the Biller’s FI or Trusted 3rd Party.

Easy Reconciliation

The transaction data stored in a database at the FI/Trusted 3rd Party can be invaluable for reconciliation and analysis by the Biller.

Why it matters

Any Biller who wants to lower their payment acceptance costs, and provide a convenient, fast and secure payment experience for consumers can leverage QR Code payments.

QR Code payments are especially popular with Billers who want to convert check payments to digital, have a large number of customers who have a financial account at the same FI (so they can process on-us transactions), or those who cater to an “under 40” crowd.

For more information, please visit www.matera.com.

By Sarah Hoisington (Sarah.Hoisington@Matera.com)

Sarah Hoisington is VP of Strategy & Marketing of Matera, U.S. Founded over 30 years ago in Brazil, Matera is a technology company that provides instant payments, QR code payments and digital ledger technology to financial institutions. Matera’s solutions are used by 2 out of the top 3 global banks, 3 of the top 10 U.S. banks and 1/3rd of all banks in Brazil. Over 300 million Pix instant payments are processed per month using Matera’s solution and 60 million of those are initiated by QR Codes. Sarah has specialized in payments and fraud for over 20 years and is currently focused on Matera’s global expansion to the U.S.