QR codes are the key to unlocking instant payments in the U.S., and are powered by sophisticated technology that facilitates the secure transfer of encrypted financial data.

What’s involved in creating a QR Code standard? How can we standardize this technology in the U.S. to promote ubiquity?

Generating QR Codes For Payments

QR Codes generated for payments are represented in two ways - visually as a series of boxes and technically as a string of alphanumeric characters.

For consumers, they are represented visually as a series of boxes we all know to be a QR code.

An encoding scheme is leveraged to generate a visual representation that can be easily scanned by consumers. When someone scans the QR code, the transaction data is extracted from the QR code's visual representation.

For back-office systems, they are represented as a string of alphanumeric characters. Each position in the string provides information about a payment transaction including things like the transaction amount, currency, biller/merchant information etc. See Appendix for more details.

This string essentially provides the payment instructions so any back office system of a Financial Institution or Trusted Third Party (familiar with what's in each position of the string) can process the payment automatically.

00020101021226990019com.matera.clp2572QRS2TXVVRYWK48C2C0SZ7ISSPWFFDD5204000053038405406100.005802US5923OklahomaGas&Electric6008Oklahoma62070503***6304CD57

Creating a QR Code Standard

If the characters in this string follow an agreed upon pattern or “standard” then any technical system configured to read this string knows how to process the QR Code payment.

In Brazil, for example, the Central Bank mandated that all QR Codes generated for Pix payments follow a specific standard based on EMVco. This standard facilitated an open-loop ecosystem for QR Code Pix payments and accelerated the adoption of Pix.

In practice, this means that a QR code generated by Brazilian Bank A for Merchant A can be scanned and paid by Brazilian Bank B’s consumer. Because every bank knows what information is in which field of the QR Code alphanumeric string, Bank B’s back office systems know how to process the payment for the QR Code generated by Bank A.

Adapting Brazil's QR Code Standard For The U.S.

This same well-established, proven EMVco-based standard used in Brazil that facilitates over 600 million Pix transactions per month can be modified to accommodate the U.S. market.

There are only 14 fields of information in the Brazilian Dynamic and Static QR Code Standards. All the fields can stay the same for the U.S. market; only the content of a few fields has to change.

For example, in a Dynamic QR Code:

- For the Transaction Currency Code, 986 represents Brazilian Reais; 840 represents U.S. dollars

- For the Country Code field, BR is used for Brazil and US for the United States

- For the Merchant Account Information a URL is used in Brazil and a Reference ID is used in the U.S. to indicate the location of the QR Code database

QR Codes generated by Matera for the U.S. follow the exact same vetted standard as used in Brazil.

The Appendix provides more details of each field in the EMVco-based QR code strings for both Dynamic and Static QR codes.

Why it matters

There is huge value in aligning the payments ecosystem (FIs, Trusted Third Parties, merchants, billers) to establish a standardized format for generating QR Codes for payments.

This alignment creates an “open” ecosystem for QR Code payments so that a QR code generated by BNY Mellon for a biller, for example, can be scanned and paid for by a consumer who has an account at Regions Bank. If these two Financial Institutions support instant payments, then the payment can be processed quickly and inexpensively on RTP or FedNow.

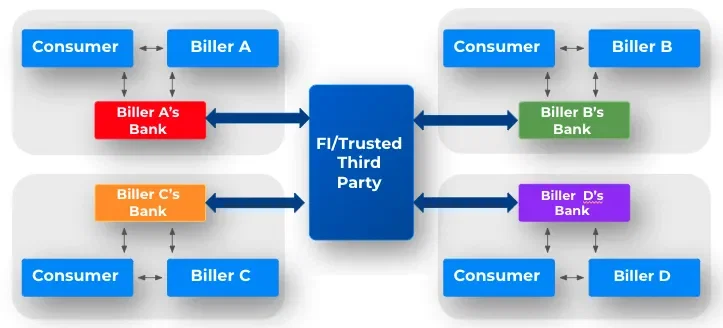

Without a standard, the best way to leverage QR Codes for payment is in a closed loop environment where the Financial Institution/Trusted Third Party generating the QR Code is also decoding it once scanned and facilitating the payment.

Examples of closed loops include transit, healthcare, universities, bank as biller or any payment scenario where the merchant/biller and consumer have an account at the same Financial Institution.

These "closed loops" can be quite large if a Financial Institution/Trusted Third Party provides services to others.

These closed loops work great, but can be improved upon if the payments ecosystem as a whole uses the same string of alphanumeric characters when generating a QR Code.

Ultimately, a QR Code standard creates an open payments ecosystem that can pave the way to faster instant payment adoption in the U.S.

For more information, please visit www.matera.com.

By Sarah Hoisington (Sarah.Hoisington@Matera.com)

Sarah Hoisington is VP of Strategy & Marketing of Matera, U.S. Founded over 30 years ago in Brazil, Matera is a technology company that provides instant payments, QR code payments and digital ledger technology to financial institutions. Matera’s solutions are used by 2 out of the top 3 global banks, 3 of the top 10 U.S. banks and 1/3rd of all banks in Brazil. Over 300 million Pix instant payments are processed per month using Matera’s solution and 60 million of those are initiated by QR Codes. Sarah has specialized in payments and fraud for over 20 years and is currently focused on Matera’s global expansion to the U.S.