The average American spends over five hours on their mobile device each day. They check their phones, on average, 96 times per day and 90% of mobile time is spent using apps.

Enabling consumers to scan QR Codes from their mobile phone to make payments creates even more utility for this device that they already find indispensable.

QR Codes are the key to unlocking instant payments, and are facilitated by sophisticated technology that orchestrates a series of APIs to generate, scan and pay QR Codes.

But, what is the consumer experience like to make a QR Code payment?

Merchant-Presented QR Codes

Technically, there are two types of QR Codes that can be used for payments: Merchant-Presented and Consumer-Presented. This post will focus on Merchant-Presented where a biller or merchant presents a QR Code for a consumer to scan and pay. Consumer-Presented will be addressed in a future post.

Requirements

For starters, consumers who want to pay by QR Code must have a mobile app with the following functionality:

- Camera that is configured with intelligence to interpret QR Codes

- Screens designed to display payment transaction information

- An option for consumers to authorize payments

Consumer Experience

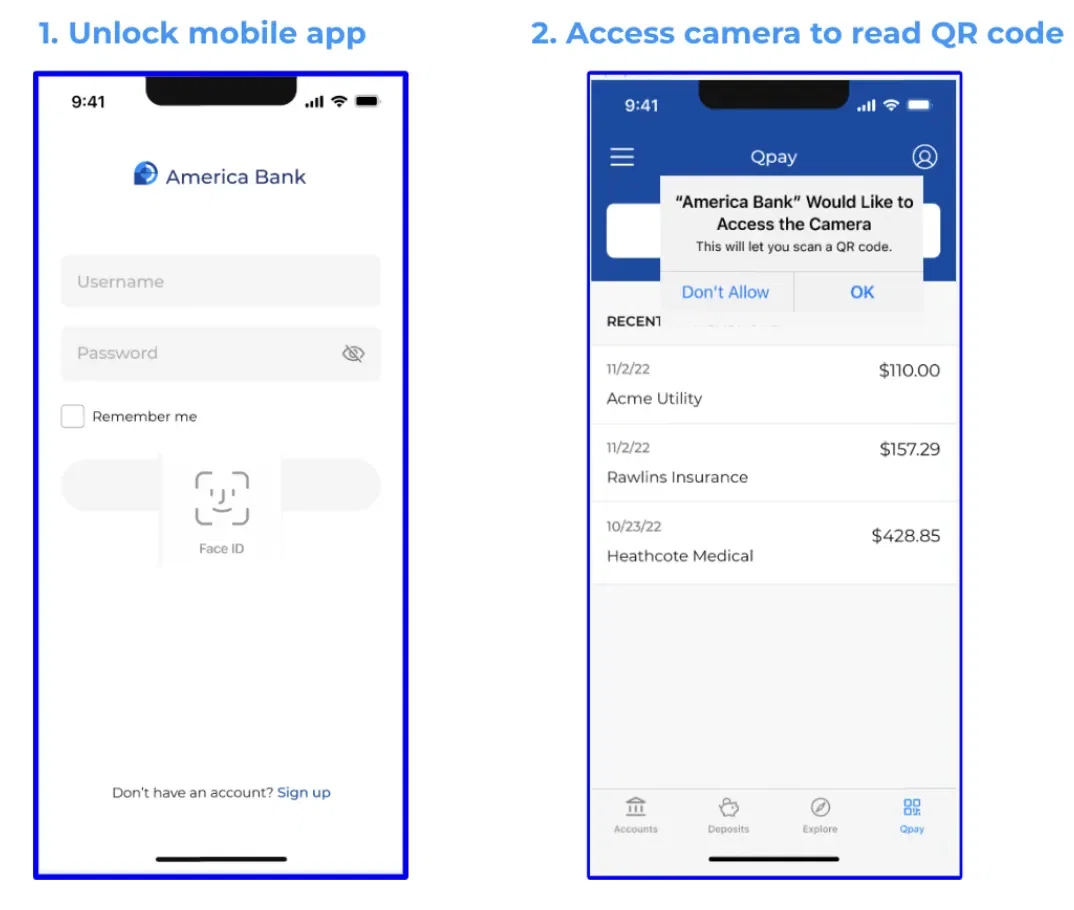

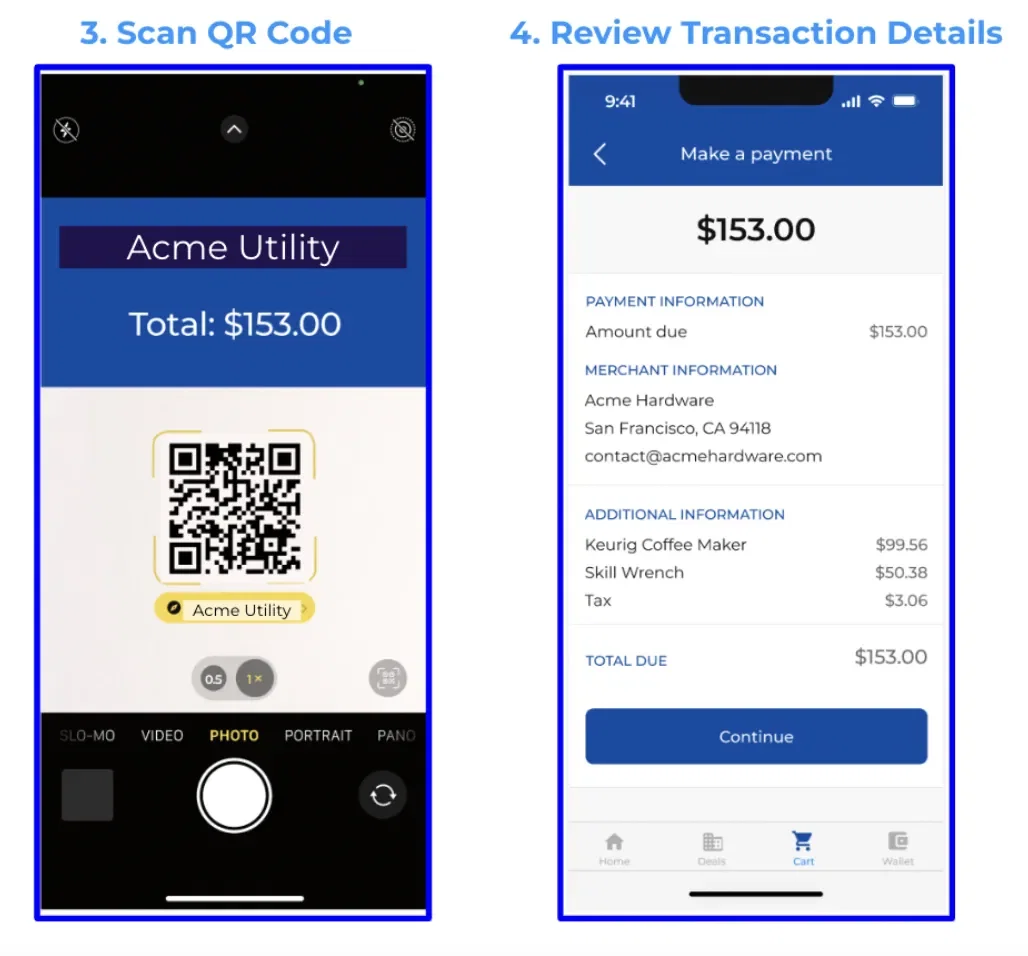

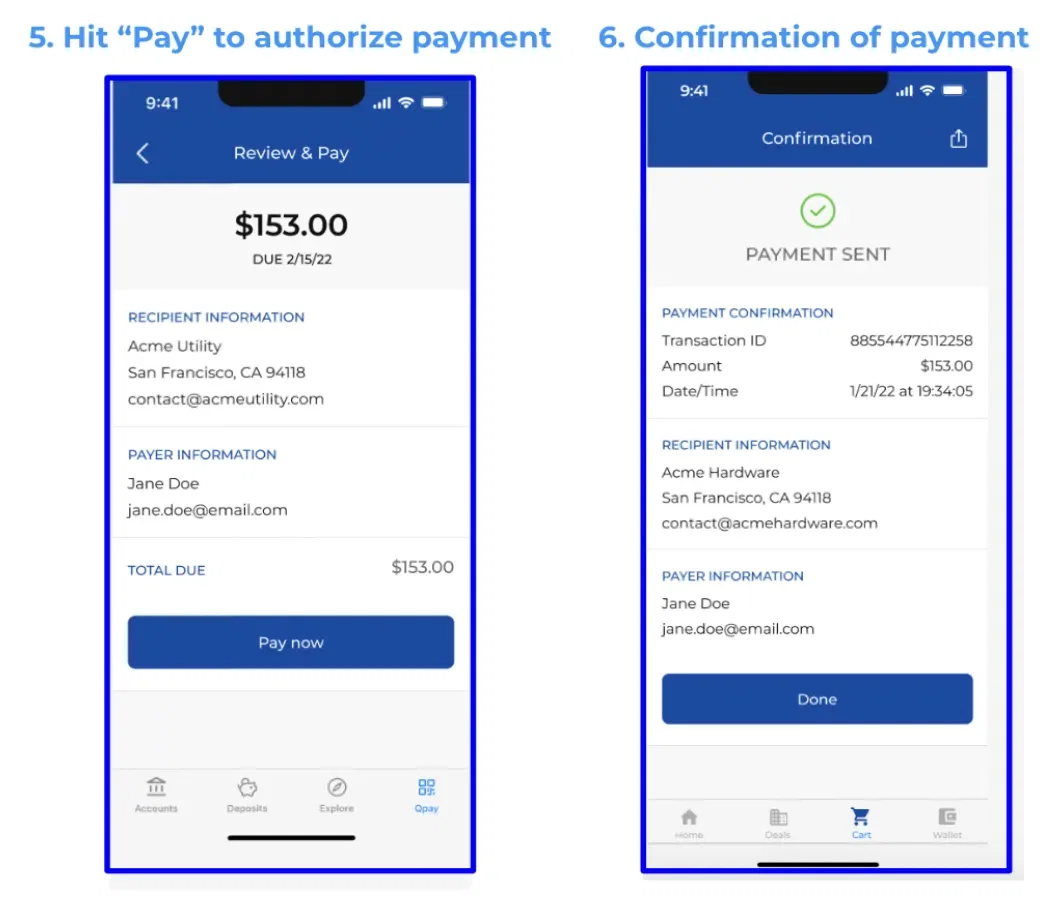

When using a mobile app equipped with the above capabilities, consumers can pay a QR Code at point of sale, at checkout online or on a physical paper invoice, in six steps:

Unlike Request for Payments, no notification of payment due is required for consumers to pay by QR Code. Consumers are made aware that QR Codes are available for payment when they see it at POS in-store, at online checkout or when it’s presented on a bill or invoice.

For consumers, there’s typically nothing they need to do to “opt in” for QR Code payments - it’s either a capability in their bank or merchant mobile app or not. They may have the ability to load payment methods to access once a QR Code is scanned, but there’s minimal setup required.

And, consumers don’t have to share any sensitive financial information to initiate QR Code payments. Because they are scanning a QR Code from within an “authenticated” app, the required financial account details are encrypted and shared via API with the payment processor behind the scenes. They don’t have to worry about sending money to a fraudster as the technology underlying the QR Code generation validates its legitimacy when scanned, plus the consumer is shown the name of the business they are paying on their mobile screen.

Low Friction Options

For those concerned about friction in requiring consumers to scan QR Codes from within their mobile apps, there are other ways to initiate the scanning of QR Codes.

There is a way to configure the process so consumers can scan the QR Code from their mobile phone camera to kick off the payment process.

A widget can also be added to a mobile phone lock screen that, when pressed, automatically launches the QR Code scanner from within a mobile app.

The End Game

Convenience, speed, and security are hallmarks of the QR Code payments experience for U.S. consumers. No need to pull out credit cards, find cash or write a check when making a payment. With QR Code payments consumers can simply use their mobile device, something that’s already a vital part of their everyday life.

For more information, please visit www.matera.com.

By Sarah Hoisington (Sarah.Hoisington@Matera.com)

Sarah Hoisington is VP of Strategy & Marketing of Matera, U.S. Founded over 30 years ago in Brazil, Matera is a technology company that provides instant payments, QR code payments and digital ledger technology to financial institutions. Matera’s solutions are used by 2 out of the top 3 global banks, 3 of the top 10 U.S. banks and 1/3rd of all banks in Brazil. Over 300 million Pix instant payments are processed per month using Matera’s solution and 60 million of those are initiated by QR Codes. Sarah has specialized in payments and fraud for over 20 years and is currently focused on Matera’s global expansion to the U.S.