QR Codes are key to unlocking instant payments, but how do they work?

To be clear, technology that powers QR Codes varies widely. The most common type of QR Code in the U.S. is the simple URL redirect used to scan and view a menu at a restaurant.

QR Code technology for payments is much different. This sophisticated technology does the following:

- Generates QR Codes for the secure transmission of financial data related to a payment order

- Includes more than just transaction data in the QR Code

- Stores transaction data in a database to support investigation & analysis

- Manages the expiration of QR Codes

- Tracks the status of QR Codes to prevent duplicate payment

- Automatically calculate discounts and fees in real-time

- Validates that a QR Code hasn’t been spoofed, tampered with or already been paid.

The software that powers QR Code payments orchestrates a series of API calls to make all of this happen, and can be operated by a Financial Institution or Trusted Third Party.

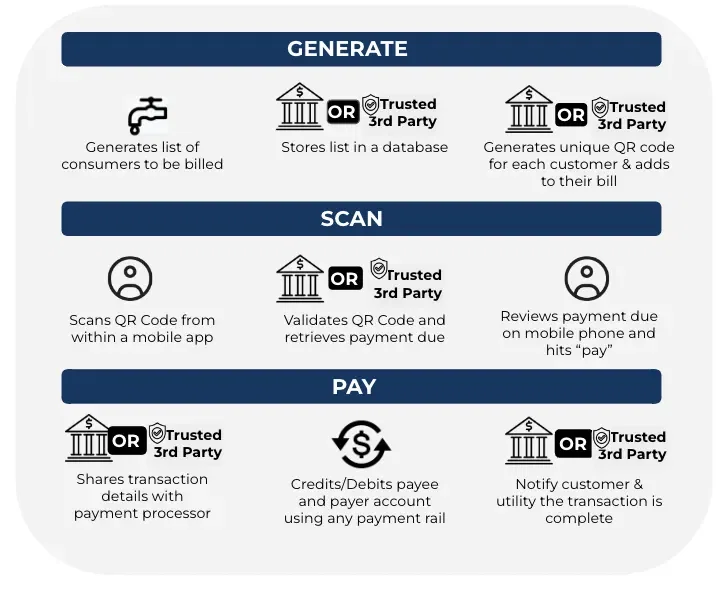

This series of API calls operating behind the scenes of a QR code payment transaction can be broken down into three key steps:

- Generate

- Scan

- Pay

Utility Bill Example

When a QR code is used to pay a utility bill, here’s what happens at each step (click the image below for more details).

This example showcases that QR codes can securely facilitate the exchange of transaction and financial information digitally, and the settlement of funds can happen over any payment rail including ACH, instant payments, cards, points, crypto etc. It could even be settled as an “on us” transaction if the consumer and the utility company have an account at the same financial institution.

The bottom line

QR code payments work in a way that provides a convenient, secure and low cost means to facilitate payments. Consumers can make payments within seconds without having to share bank account or related information.

The technology underlying QR code payments ensures that they can’t be spoofed, tampered with or paid twice.

Billers and merchants can offer QR code payments to move traditional payments (e.g. checks) to digital, and leverage low-cost instant payment rails.

For more information, please visit www.matera.com.

By Sarah Hoisington (Sarah.Hoisington@Matera.com)

Sarah Hoisington is VP of Strategy & Marketing of Matera, U.S. Founded over 30 years ago in Brazil, Matera is a technology company that provides instant payments, QR code payments and digital ledger technology to financial institutions. Matera’s solutions are used by 2 out of the top 3 global banks, 3 of the top 10 U.S. banks and 1/3rd of all banks in Brazil. Over 300 million Pix instant payments are processed per month using Matera’s solution and 60 million of those are initiated by QR Codes. Sarah has specialized in payments and fraud for over 20 years and is currently focused on Matera’s global expansion to the U.S.