Pix is the instant payments scheme developed, managed and operated by the Central Bank of Brazil. It launched in November 2020 to instant success. The metrics tell the story.

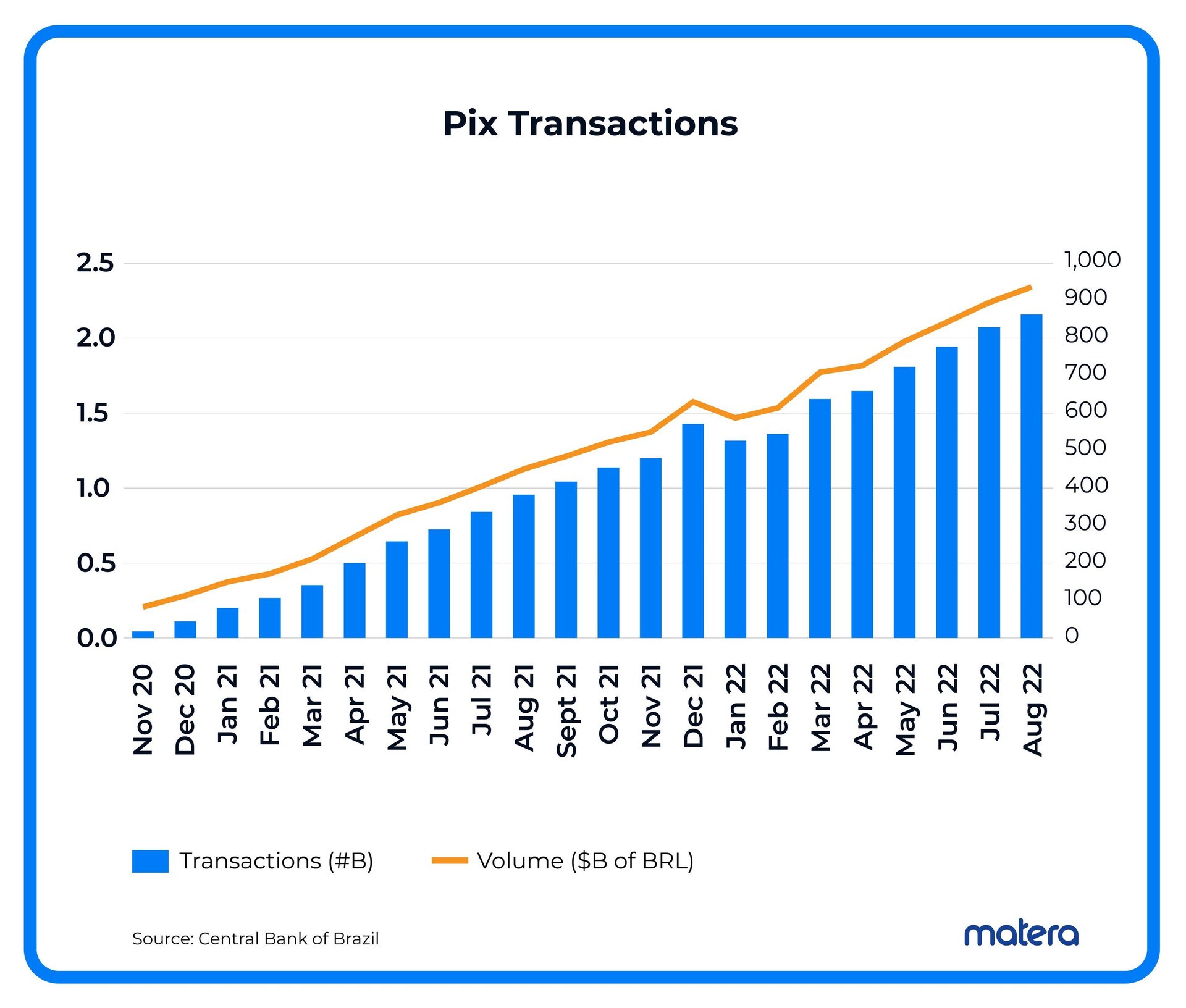

Growth in Transactions

The total number of Pix transactions continues to climb. There are now over 2.2B Pix instant payments transactions per month.

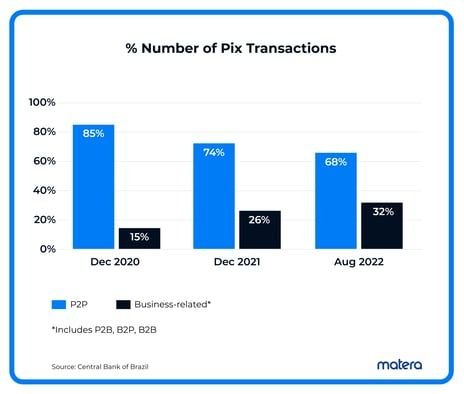

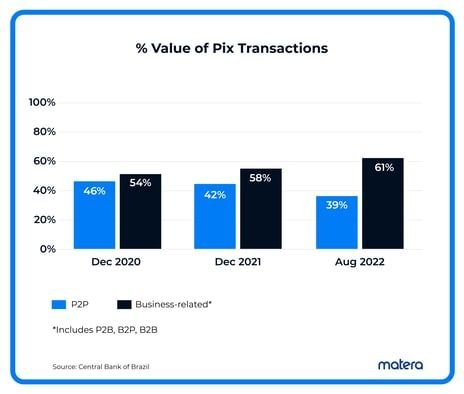

Transactions By Type

Business-related transactions continue to drive the growth in Pix. 32% of Pix transactions are business-related, the majority are P2B or consumers paying merchants. Merchants love Pix. It’s much cheaper for them than other forms of payment. And, they get their money instantly.

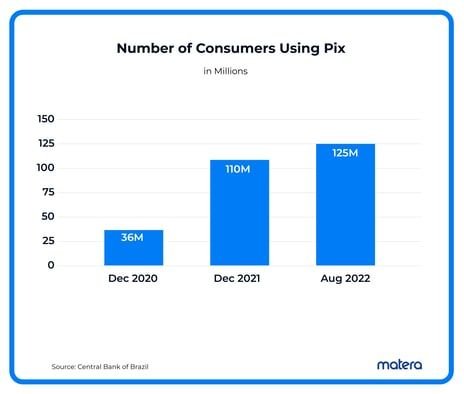

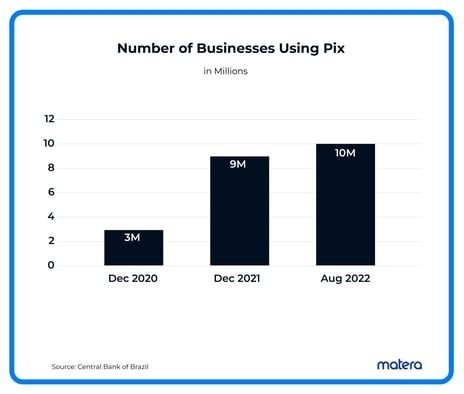

Pix Users

Over 125M consumers and 10M businesses use Pix.

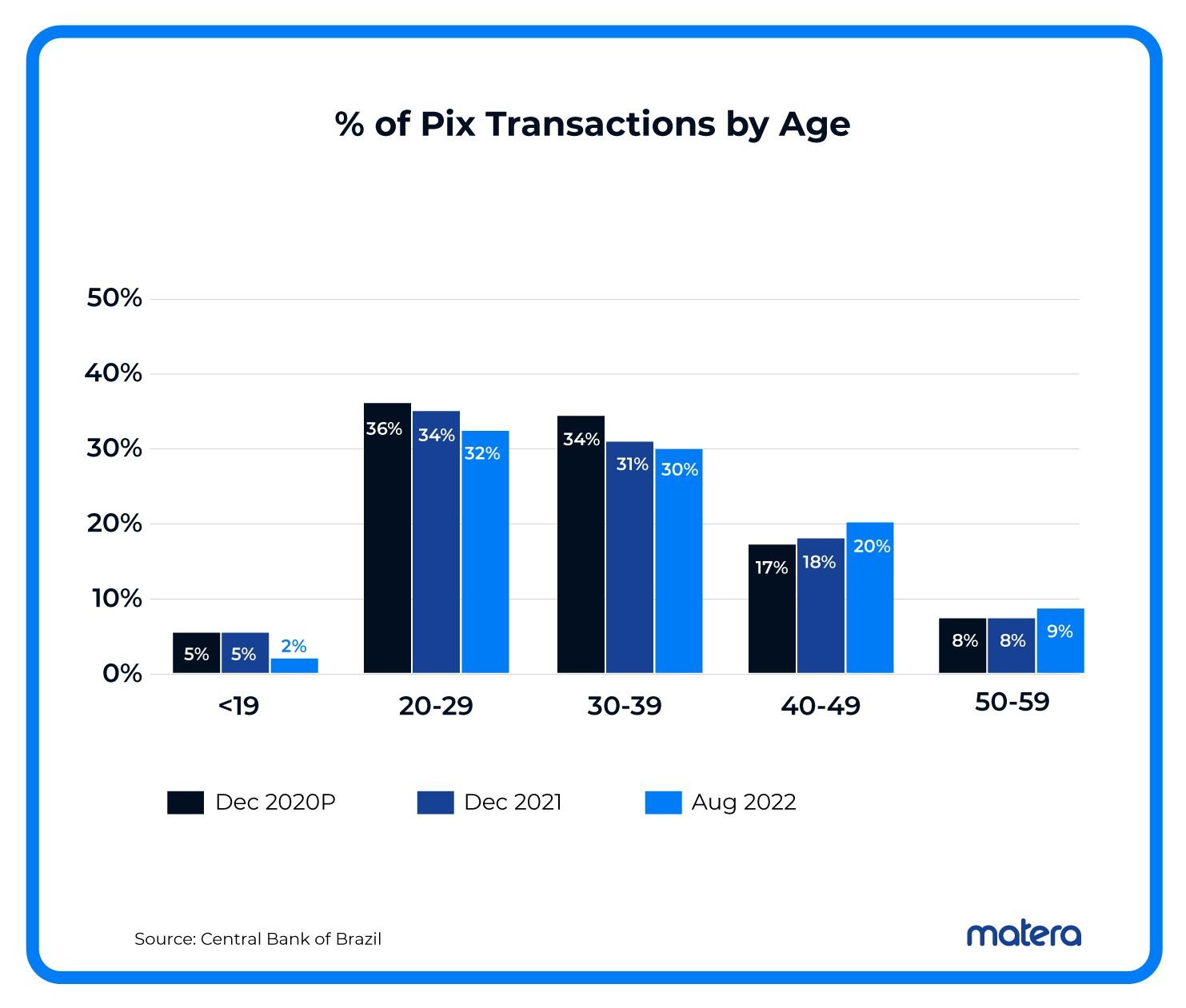

Transactions By Age

82% of Pix Transactions are by consumers aged 20 - 49.

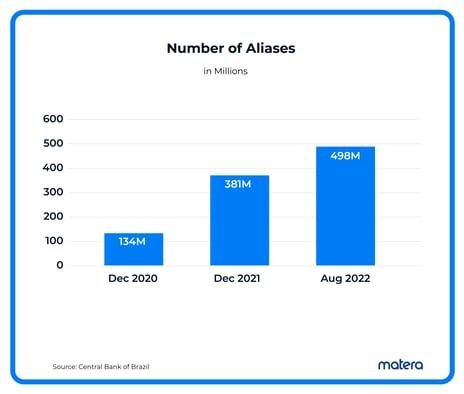

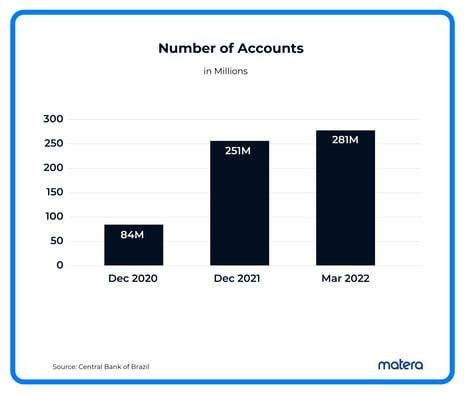

Aliases in the Pix Directory

Pix adoption was driven in part due to the directory managed by the Central Bank of Brazil. The directory contains the alias that consumers and businesses associate with their financial accounts. There are 4 types of aliases – mobile phone, email, tax id (companies)/SSN (consumers) or randomly generated number. Consumers can have up to 5 aliases per account; businesses up to 20 aliases per account.

There are nearly 500M aliases across 281M accounts.

For more information about Pix, check out The Pix Story.